Global Capitalism - By Richard Wolff

Published: June 28, 2017

Economist, Richard Wolff is a Professor of Economics Emeritus at the University of Massachusetts, Amherst, and Visiting Professor at the New School graduate program in International Affairs in New York.

Economist, Richard Wolff is a Professor of Economics Emeritus at the University of Massachusetts, Amherst, and Visiting Professor at the New School graduate program in International Affairs in New York.

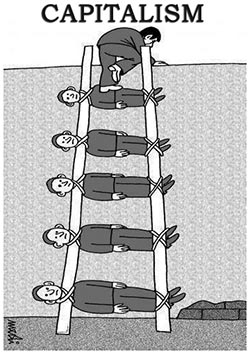

Wolff’s work challenges the conventional wisdom that capitalism is the ideal framework for the political economy. More recently, he has concentrated on analyzing the causes and alternative solutions to the global economic crisis. In 2010, Wolff put his economic theory into action, and co-founded Democracy at Work, a project that aims to build a social movement and society whose workplace is more equitable, sustainable, and democratic.

Over the years, Wolff has written extensively and published many books including Democracy at Work: A Cure for Capitalism, Occupy the Economy: Challenging Capitalism, and Capitalism Hits the Fan: The Global Economic Meltdown and What to Do About It, which was also made into a DVD.

Wolff’s bold and persuasive economic ideas have helped him establish a strong media presence. He writes regularly for The Guardian and Truthout.org, and has been interviewed by Amy Goodman’s Democracy Now!, Al Jazeera English, and National Public Radio. He is also a frequent lecturer at colleges and universities across the country.

Wolff earned his PhD in Economics and MA in History from Yale University, an MA in Economics from Stanford, and a BA in History from Harvard. He lives in New York with his wife, Dr. Harriet Fraad, a psychotherapist.

Understanding Marxism: Q&A with Richard D. Wolff

Published: June 13, 2019

Understanding Marxism Q&A with Richard Wolff, Prof. Wolff talks about the impetus for the book and why Marxism is appealing to a growing audience.

Prof. Antony Davies: 10 Myths About Government Debt

Published: October 16, 2017

Professor Antony Davies explains the many miss-understandings about Government Debt. Myth 1 is that the government owes “only” $20 trillion. (In reality, it’s much more.) But luckily, Myth 10 is that there’s no way to fix this problem…

Myth number one, the government owes $20 trillion. How much is $20 trillion? Suppose you go to Germany, and in Germany, you go to every town. In every town, you visit every store. In every store, you look at every shelf and grab everything that is for sale. The amount of money you spend will not be $20 trillion. If you go to Germany and then to France and you go to every town, and within every town, you go to every store. In every store, you look on every shelf and you buy everything. You still will not have spent $20 trillion. You can go to England and while you’re there, you can go to the North Countries and buy everything that’s for sale, and you still will not have spent $20 trillion. In fact, to spend $20 trillion, you have to go to every country in Europe, visit every town, in every town, go to every store. In every store, look on every shelf and buy everything. And then you will have spent about $20 trillion.

But the myth is that this is how much money the government owes. It turns out that there’s more, called unfunded obligations. Unfunded obligations is money the Federal Government has promised but which it does not and will not have the money to pay. Largely, this consists of promises of retirement and medical benefits. If you would take the present value of all the future promises of retirement and medical benefits the government has made and subtract from that the amount of money that’s in the government’s Social Security and Medicare trust funds, and then subtract from that the amount of money the Federal Government anticipates collecting under the current law from future Social Security and Medicare taxes, you will still have an amount of money left over that the government does not have.